The Constraints of the Black-Scholes Model: A Data-Driven Analysis

The Black-Scholes model like all models, it comes with its own set of assumptions, some of which have shown to be oversimplified or even flawed. In this post, we’ll explore these assumptions and, using historical market data, analyze their shortcomings.

Assumptions of the Black-Scholes Model:

- European-style options: Can only be exercised at expiration.

- No dividends are paid out during the option’s life.

- Efficient markets: No transaction costs or taxes; all information is available to all market participants.

- Risk-free rate and volatility of the underlying are known and constant.

- Returns on the underlying are normally distributed.

- No arbitrage opportunities.

- The underlying security doesn’t pay a dividend.

- It’s possible to short-sell the underlying security without incurring a cost.

Analyzing Assumptions Using Historical Market Data

To critically evaluate some of the assumptions, we’ll fetch historical market data and analyze it against the Black-Scholes framework.

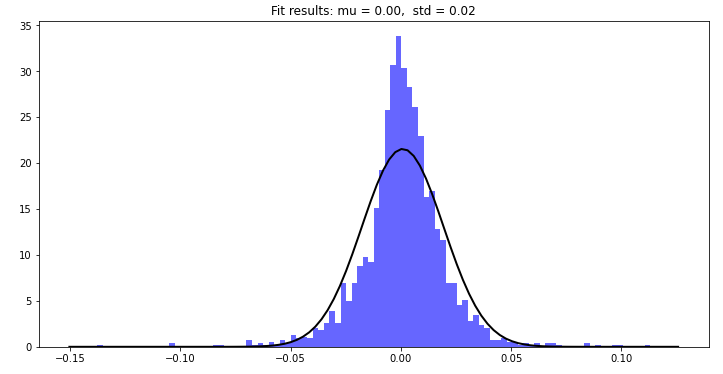

Assumption: Returns on the underlying are normally distributed.

Let’s see if this holds true for a popular stock.

import numpy as np

import pandas as pd

import yfinance as yf

import matplotlib.pyplot as plt

from scipy.stats import norm

# Setting up yfinance to fetch data

yf.pdr_override()

# Fetching data for Apple Inc. using yfinance

data = yf.download('AAPL', start='2015-01-01')

# Calculating log returns

data['Log Returns'] = np.log(data['Close'] / data['Close'].shift(1))

# Plotting the histogram of returns

plt.figure(figsize=(12,6))

plt.hist(data['Log Returns'].dropna(), bins=100, density=True, alpha=0.6, color='b')

# Plotting the normal distribution for comparison

xmin, xmax = plt.xlim()

x = np.linspace(xmin, xmax, 100)

p = norm.pdf(x, data['Log Returns'].mean(), data['Log Returns'].std())

plt.plot(x, p, 'k', linewidth=2)

title = "Fit results: mu = %.2f, std = %.2f" % (data['Log Returns'].mean(), data['Log Returns'].std())

plt.title(title)

plt.show()

From the above plot, we can observe that real market returns often exhibit fatter tails compared to the normal distribution, challenging the assumption of normally distributed returns.

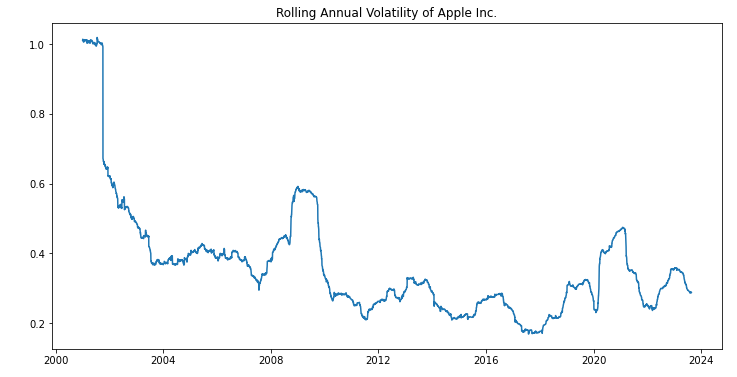

Assumption 2: Risk-free rate and volatility of the underlying are known and constant.

Let’s fetch the data using yfinance and adapt the code for plotting the rolling annual volatility and dividend payment history of Apple Inc.

Here’s the code:

import numpy as np

import pandas as pd

import yfinance as yf

import matplotlib.pyplot as plt

# Setting up yfinance to fetch data

yf.pdr_override()

# Fetching data for Apple Inc. using yfinance

data = yf.download('AAPL', start='2000-01-01')

# Calculating log returns

data['Log Returns'] = np.log(data['Close'] / data['Close'].shift(1))

# Plotting volatility (rolling standard deviation) of Apple Inc. stock returns

data['Volatility'] = data['Log Returns'].rolling(window=252).std() * np.sqrt(252)

plt.figure(figsize=(12,6))

plt.plot(data.index, data['Volatility'])

plt.title('Rolling Annual Volatility of Apple Inc.')

plt.show()

From the plot, you can see that volatility changes over time, suggesting it’s not constant.

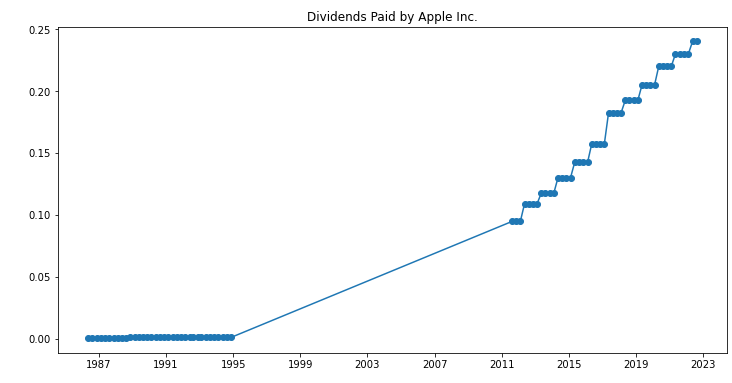

Assumption 3: The underlying security doesn’t pay a dividend.

Fetching dividend data from Yahoo Finance using yfinance

div_data = yf.Ticker('AAPL').dividends

plt.figure(figsize=(12,6))

plt.plot(div_data.index, div_data, 'o-') # Using 'o-' to mark dividend points

plt.title('Dividends Paid by Apple Inc.')

plt.show()

If the plot shows any peaks, it indicates dividend payments, proving that many stocks indeed pay dividends.

Conclusion

While the Black-Scholes model is a foundational pillar in financial modeling, it’s imperative to understand its limitations. As demonstrated, some of its core assumptions don’t always align with real market behavior.

You can then extend this analysis for the rest of the assumptions. Some of them might not be easily disproven with data alone and might require a more theoretical or qualitative analysis.